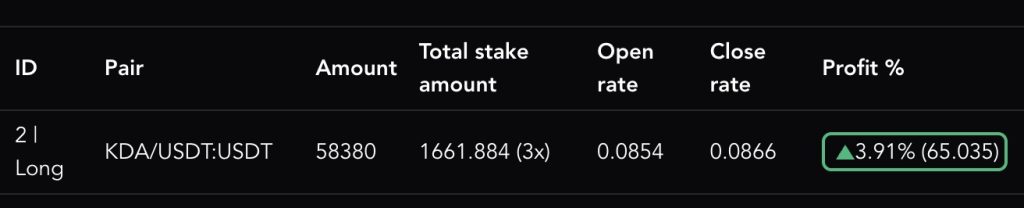

For disclaimer, I never trade on forex nor stock exchange using leverage, so crypto is my first time trading using leverage. Apparently there are some differences between how crypto exchanges applies leverage compared to forex/stock according to some users, which leads to some confusions. This post aims to clear such issue. Okay, let’s get started. Take a look at this leveraged trade.

I’ll explain all the numbers there step-by-step. First, the stake amount used is 1661.884. Open rate is 0.0854. So before leverage, you should only receive amount of 1661.884 / 0.0854, which is 19.460. Since we are using leverage of 3x, the amount you get is 19.460 * 3, which is 58.380.

Next, we will see how the profit number matched. Open rate is 0.0854, close rate is 0.0866. The percentage change is (0.0866 – 0.0854) * 100 / 0.0854 = 1.4%. Fee for maker on Binance is 0.05%, so if we include fee, the real profit % is 1.4 – (2 * 0.05) = 1.3% before leverage. Since we are using 3x leverage, the profit we get is 1.3 * 3 = 3.9%. The absolute profit we get is 0.039 * 1661.884 = 64.813476 USDT, which is similar to the numbers above. Discrepancy come from the real fees being applied, since we are using blanket fee on the calc above.

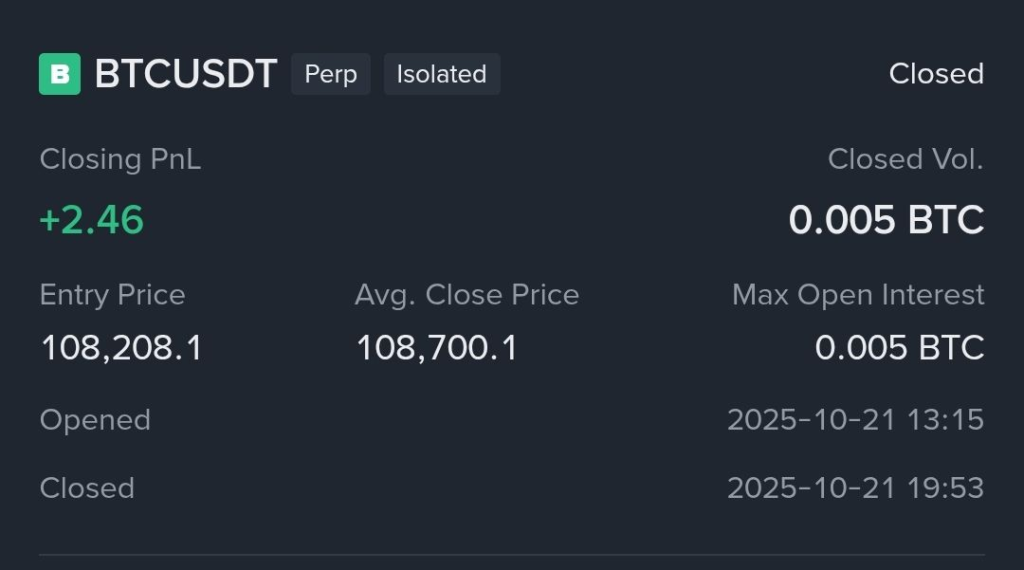

Now I will show another example of leveraged trading. Image below is from Freqtrade’s database (using Dash Bot app)

Image below is from exchange’s record

As you can see, the numbers all matched, except for small difference in absolute profit, since exchange don’t include fees in its profit calculation. Hope this will clear any confusion. If you don’t believe the steps above, do trade manually on crypto exchange, for example Binance, then use the steps above. You will see that it will matched.

[…] How Freqtrade apply leverage […]